Public REITs (Real Estate Investment Trusts) are a popular gateway for investors looking to provide their portfolio with exposure to commercial real estate (CRE) investing.

A REIT is a product of the tax code designed to promote passive CRE investing to the masses. They’re a vehicle to allow anyone the opportunity to invest (trade) interests in commercial real estate.

But are they right for you?

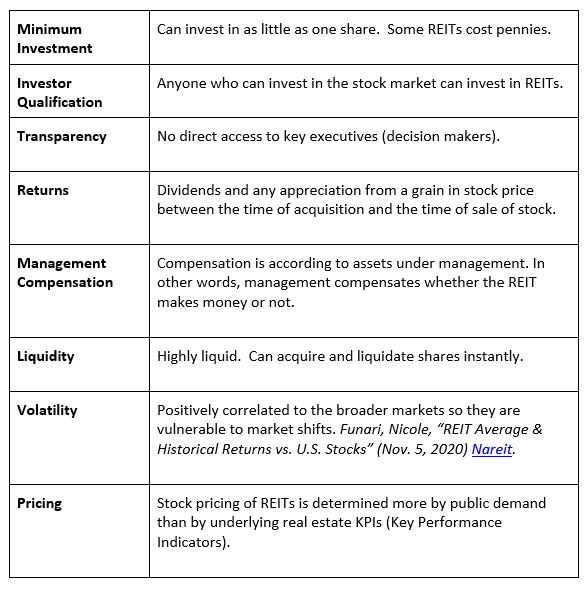

Here are public REITs in a nutshell:

Access and the low cost of entry are two of the leading reasons for the popularity of REITs.

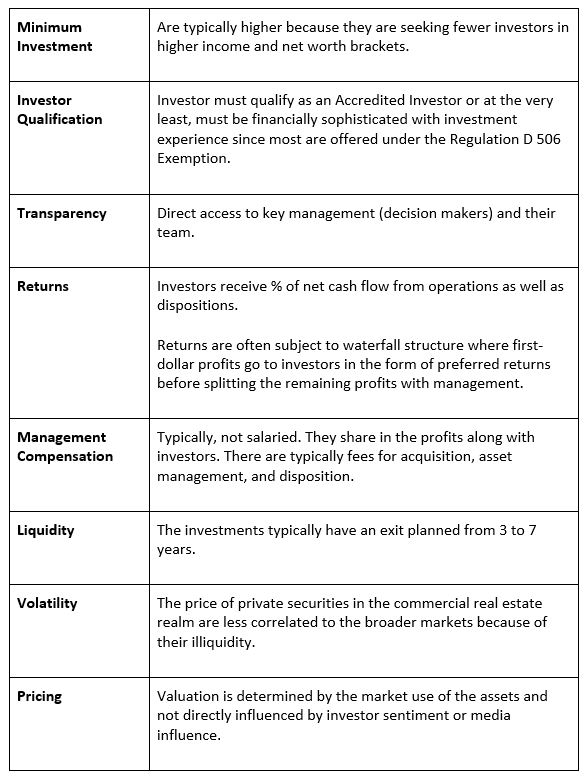

However, an investment through a real estate fund or syndication may be a better option for investing in the in-demand and lucrative multifamily space.

There are a few key differences between REITs and private funds. Let’s take a look.

When comparing REITs vs. private CRE, proponents of REITs point out accessibility and low cost of entry as advantages.

However, sophisticated investors know better. It’s this same accessibility, low cost of entry, and liquidity that also contribute to the volatility of REITs. In other words, when the market crashes, REITs are not immune.

REIT executives are salaried and receive additional compensation based on a percentage of funds under management. Because REITs pay dividends as a percentage of taxable income, taxable income can be reduced dramatically by management compensation, in addition to a myriad of other fees, leaving little for distribution to investors.

With private investments, management is typically not salaried, leaving more profits for distribution to investors.

If you’re looking to invest in multifamily, consider a private investment first.

Those who want to treat real estate like they would the stock market should invest in REITs.

But if you want more transparency, cash flow and tax benefits, then apartment syndications might be for you.